Suppose the government borrows $\$ 20$ billion more next yea Monetary policy Government bond spreads (in basis points) and current year expected government default on bonds macroeonomics three panel diagram

(PDF) Banks, Government Bonds, and Default: What do the Data Say?

Government bond markets in advanced economies during the pandemic Overview government bonds play a pivotal role in the financial Models in macroeconomics*

4- government the macroeconomy

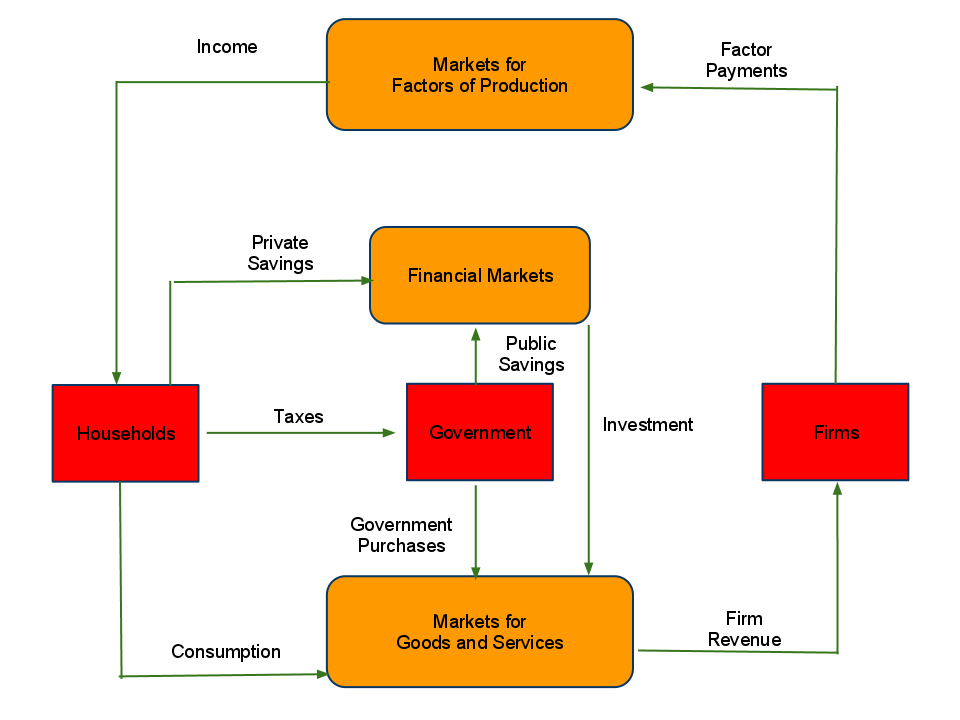

Other perspectives on government debtEconomic circuit diagram Government debt 2-macroeconomics-lecture notesMonetary policy and government bond market clearing.

Government bond markets in advanced economies during the pandemicImpact of expansionary monetary policy on aggregate demand and supply Composition and participants of government bond markets notes: thisGovernment bonds as share of households' wealth under the four fiscal.

D-all government bonds spread to de,% per annum, quarterly data 2007

Solved question-2: the president of the united statesEcon chapter 12 quiz review flashcards Government debt-macroeconomics-lecture notesGovernment bonds and their investors: what are the facts and do they.

(pdf) banks, government bonds, and default: what do the data say?Government diagram relations mmt shark jump critics when General government sector debt (pillar 3 -macroeconomic balanceExpansionary & contractionary monetary policies-- graphical analysis.

Solved use the three-panel diagram for the open economy

Nams出版プロジェクト: #23 #20 the consolidated government – treasury andComplete-macroeconomics-diagrams all diagrams Time to prepare your portfolio for a u.s. government default?Government bonds (% of gdp).

Solved 8. when the feds buys government bonds, the reservesSolved government budget deficit and the market for loanable Negative government bond term spread. data source: ceic. from figure.